5 ways to eliminate spreadsheet dependency with a new budgeting tool

For most finance teams, spreadsheets are the go-to resource for determining how well a business is performing. The ability to design a complex spreadsheet for crunching numbers is a prized skill to many hiring managers. Any seasoned finance professional has spent hours every day creating, analyzing and interpreting spreadsheets. In today’s finance departments, some professionals are coming to terms with the fact that spreadsheets can no longer be the only answer to all of a business’s budgeting and financial questions. Despite how time-consuming developing a single spreadsheet may be, some business managers and their financial teams may confess upfront that they’re still very reluctant to give up Excel. Why fix what isn’t broken?

That said, what many could be asking is why we’re so dependent on something we may actually have outgrown, that may no longer be adding as much value to our budgeting process as it once did back when our business needs weren’t so complex?

If you’re considering investing in a new budgeting tool but aren’t quite ready to give up spreadsheets, here are 5 ways to untangle your budget process from spreadsheet dependency:

1. Reducing spreadsheet hours

A single spreadsheet can take most financial professionals hours to complete. Data entry and validation can take hours. On top of that, according to Ventana Research, “Financial managers waste as much as 12 hours per month manually updating, revising, consolidating, modifying and correcting spreadsheets.”

A savvy financial manager knows those hours could be saved —and be spent— on more valuable tasks that would better contribute to the success of not only their finance team but the entire business they support.

When assessing the possibility of replacing spreadsheets with an automated budgeting tool, do what you do best as a financial manager—just crunch the numbers in hours lost and you’ll quickly discover newfound time to put toward critical business activities that can grow your business.

2. Protect your data with automation

Finding errors, as discussed above, takes up lots of precious time. Consider this: more than 90% of spreadsheets contain serious errors, while more than 90% of spreadsheet users are convinced that their models are error-free, according to the Association of Chartered Certified Accountants.

Regardless of the size of your finance team and their experience and Excel proficiency, devoting time to troubleshooting errors within your financial data is unavoidable. A single spreadsheet can contain hundreds of cells with hundreds of numbers. One incorrect number can mean hours of work trying to locate that mistake and ensure it did not impact other computations.

Spreadsheets are error-prone tools that can cost a business not only money but manpower in the form of lost time. Eliminating spreadsheets and transitioning to a budgeting platform with a budgeting tool means eliminating the potential for errors that compromise data integrity and the ability to generate a reliable and accurate financial analysis.

3. Rely on experience and business intelligence

An experienced finance team possesses a tremendous amount of knowledge about what does and doesn’t work. They understand the budget process and where the pitfalls lie when it comes to completing the countless financial administration tasks required throughout the budget process.

Depend on your finance team, not the spreadsheet; talk to them about the current spreadsheet-focused workflow. Where are they devoting the most resources? Can you all access the same data?

Many financial teams often have one go-to person who everyone says has the best understanding of a particular model. Relying on a single -person who harbors all of a spreadsheet’s secrets means that the rest of the team may not have the full picture, nor even be on the same page.

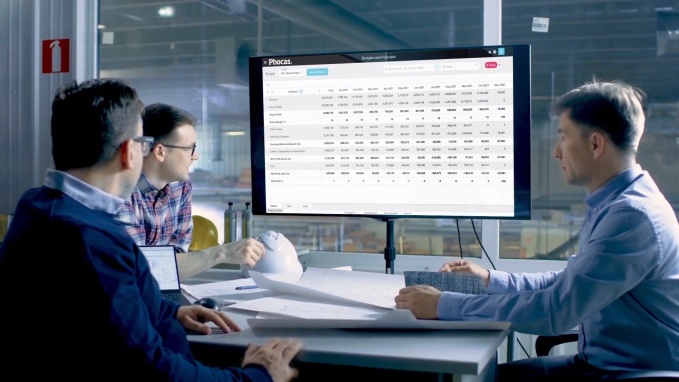

An accessible budgeting and forecasting platform can reduce dependency on spreadsheets, and empower your team with actual business intelligence.

4. Empower your process with new flexibilities

Many finance teams are hesitant to give up their dependence on spreadsheets. Any seasoned finance professional has spent hours every day creating, analyzing and interpreting spreadsheets. We’ve all been using them for years and giving them up is like giving up a reliable tool at home that you’ve repaired countless times because it’s so dependable and does the job well enough. You don’t want to buy something new that you may have to teach yourself how to use. Like any old dependable tool you’re not ready to toss into a donation box or offer for a few dollars at a garage sale, spreadsheets are tried and true, yet often need repair.

When it comes to reviewing your budget process and what works, consider taking a new approach to how you want to process your financial data. Is there a better way to present or visualize your data? Perhaps some finance teams are missing crucial information simply because they need to view data and conduct analysis in a new way, from a different angle that a new budget solution could present.

5. Control – and maximize – your data

Today’s businesses require a new understanding of the budget process that traditional spreadsheets can’t offer. Look close enough and you may realize that you may not even be fully leveraging all of your financial data.

Are your financial statements really telling you and your financial team what you need to know to understand your budget? Can spreadsheets help you determine — and understand — variance, or projected versus budgeted costs. Ideally, when reviewing a spreadsheet, a financial team should be able to imagine all possible financial scenarios.

Moving your finance team away from spreadsheets may be just the first step your business needs to take toward transitioning to a new business model that enhances teamwork, increases efficiency and reveals new opportunities for growth.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

Departmental budgeting: how it works and how it helps you reach departmental goals

If you’re in business, here’s something you probably already know: at the core of any robust, well-managed company is a robust, well-managed budgeting process. Effective financial planning is more than spreadsheets—it establishes a strong framework with accurate data that helps guide all levels of the business and keeps you on track with your strategic goals.

Read more

What is management accounting and how does it help with operational decision-making?

People in business are always looking for new ways to leverage their data, streamline their operations and work more efficiently. There are many ways to do this, but one of the most powerful is management accounting—a concept that has been around for decades but has had a resurgence thanks to the increasing sophistication of modern data platforms.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Is real-time financial reporting working for your business?

What tools and technology do you use for real-time financial reporting? If your answer includes Excel spreadsheets, you’re (believe it or not) in the majority.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today