Inventory days formula and why it's useful

Inventory days formula is equivalent to the average number of days each item or SKU (stock keeping unit) is in the warehouse. A company’s Inventory days is an important inventory metric that measures how long a product is in storage before being sold. If the metric is high, there may not be enough demand for it, the product might be too expensive or it's time to rethink how it's being promoted. If the inventory days are too low, companies risk stock outs, supply chain disruptions or ultimately losing customers.

Inventory days is also commonly referred to as Inventory Days of Supply, Days Inventory Outstanding (DIO), Days in Inventory (DII) or Days Sales Inventory (DSI).

An inventory days metric is useful for distribution businesses because it allows a proper allocation of storage costs for inventory (storage costs or holding costs are part of the overall inventory costs). The less time each item spends in inventory, the lower the cost of storage. For example, if a product has an annual storage cost of 24%, but it only remained in inventory for four months, how much was paid in holding costs for it? The answer is 8% (24% / 3). We must remember that typically the cost of storing an item is represented as a percentage of its valuation (in the previous example, 24%).

How to calculate inventory days?

To calculate inventory days, you can use the formula:

Inventory days = 365 / Inventory turnover

Use the number of days in a certain period and divide it by the inventory turnover. This formula allows you to quickly determine the sales performance of a given product.

The number used in the formula example above denotes the 365 days of a year. However, you can use any time period that suits your reporting - just make sure that it uses the same period that you use to calculate inventory turnover.

For example, imagine that you will calculate inventory days with an inventory turnover ratio of 4.32 per year. The calculation is as follows: 365/4.32, which will result in an average days in inventory of 84.49.

Inventory days: 84.49 = 365 / 4.32

If you did the operation using a different accounting period, for example, with a rotation of 2.31 over 180 days, the average inventory days would be 77.92.

How to calculate inventory turnover?

The days in inventory formula uses a specific value of inventory turnover. To calculate inventory turnover:

Inventory turnover = Cost of goods sold/Average inventory.

There are two things to keep in mind:

- Cost of Goods Sold (COGS) is the direct cost of sales of a product - expenses, labor and raw materials if manufacturing, but not general overheads like rent

- The average inventory for the same period is used.

If you had a COGS of $31,104 for widget sales over a year, and had an average of value of $7,200 widgets in stock over that time, your inventory turnover is 4.32:

Inventory turnover: 4.32 = $31,104 / $7,200

Calculating average inventory

The final piece of the days in inventory formula is average inventory. To calculate this, average the value of inventory levels throughout your accounting period (use the same period as the inventory days and inventory turnover formula). If you measured inventory at the beginning and end of your accounting period:

Average inventory = (beginning inventory + ending inventory) / 2

For example, if you had $9,134 in stock at the beginning of the year, and $5,266 at the end of the year, your average inventory would be $7,200:

$7,200 = ($5,266 + $9,134) / 2

A different way of calculating inventory days

Days in inventory can also be expressed using an inverse inventory of the turnover ratio:

Inventory days = 365 x ( 1 / Inventory turnover )

or

Inventory days = 365 x ( Average inventory / COGS )

This second formula utilizes the percentage of the products that sold in terms of cost of products sold. You can use this average to estimate the time that said product was predicted to sell. The figure resulting from this formula can be easily converted to days by multiplying this data by 365 or by a period.

What's an ideal days inventory time?

The answer is: it depends. The ideal number of days in inventory depends on the following:

- Does your company have enough cashflow to obtain the necessary inventory?

- Does your company have a certain method of calculating inventory?

- How long does it take your company to restock?

But one thing is key: getting the restocking timing accurate. Understanding your suppliers’ wait times and how long it takes to replenish your inventory will allow you to determine your ideal days in inventory and safety stock levels.

For example, if you have ten days of inventory and it takes 21 to resupply, then there is a negative time gap. If you order more products today, it will take 21 days for your supplier to deliver, while in ten days, you will be without products. As a result, you will have eleven days in which you will not meet your customers’ demands, putting you in an awkward position.

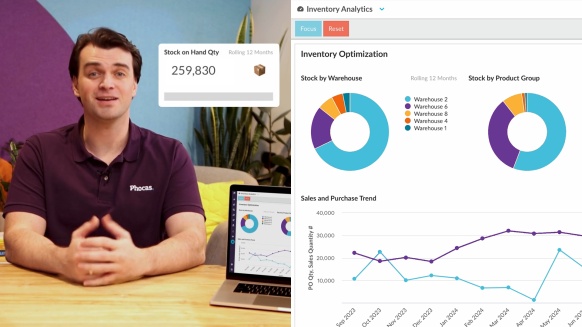

How does inventory management software improve operational efficiency?

Inventory management software helps a business to obtain an overall picture of inventory at any given time. It records all data about what inventory or stock is sourced, stored, ordered, sold and shipped. Inventory management software collates many layers of data that is often missing from ERP systems. Accurate measurement of stock enables people to plan, forecast, manage the company’s cash flow, supervise the flow of products/materials, improve the quality of customer service and ultimately improve overall operational efficiency. Integrating your inventory control systems with ERP, sales and financial data can often be the difference between staying competitive or not.

Instead of waiting for your financial analyst to update complex excel templates a number of times a year to ensure inventory ratios and liquidity are on track, automated inventory calculations can give you a real-time indication of slow-moving products, under stock or dead stock items. Up-to-date, self service inventory reporting can help reduce errors and give early warning of low inventory levels, reduce the need for ad hoc inventory counts and help your team give customers the certainty that products can be delivered on time and in full.

Empowering businesses with intuitive data analytics, driving informed decisions for growth and profitability. We make people feel good about data.

How to prepare professional board reports

Preparing effective board reports cannot be underestimated in the ever-changing and dynamic business world. They’re not only essential for communicating financial performance and operational progress, but they’re also an all-important part of strategic and intelligent decision-making.

Read more

What is sales and operations planning (S&OP)

Sales and operational planning (S&OP) helps businesses to align their strategic goals with day-to-day operations. By integrating financial planning with operational and sales planning, S&OP ensures that all departments work cohesively towards common objectives. This process operates on strategic and tactical levels, providing insights that influence long-term decisions while guiding day-to-day actions. Understanding the dual focus of S&OP is essential for creating a robust plan that addresses immediate needs while positioning the company for future success.

Read more

How connected planning software helps your strategy succeed

How many strategy days have you been on? Leaders often go offsite so they can think laterally and not be disturbed. So much emphasis is placed on strategy that the implementation of strategic business planning gets overlooked. This is often the case if the strategy is not linked to the budget or resources are not distributed correctly. One of the key reasons strategies don’t work is because business leaders don’t review the implementation or business performance frequently enough. Where does your business sit with monitoring the success of your strategy?

Read more

What is Integrated Business Planning (IBP)?

Imagine a soccer team, where each player operates independently, unaware of their teammates' actions and strategies. The forward charges ahead without knowing where the midfielders are, while the defenders are left guessing the goalkeeper's next move. Chaos ensues, and the likelihood of winning plummets. In contrast, a well-coordinated team, communicating effectively, and working towards a common goal, significantly increases its chances of success. This analogy mirrors the concept of Integrated Business Planning (IBP) in a business context. Just as a successful soccer team requires cohesive strategy and communication, a business thrives when its departments are aligned and collaborative.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today