Keep the festival going with efficiency ratios

As we continue on our festival of metrics, today we’re headlining with efficiency ratios. Efficiency ratios are designed to ensure a business is making good use of its assets, collecting its debts, selling its stock, and settling payables. If your company manages stock in the manufacturing and distribution industries, efficiency ratios are a must-have tool.

The importance of efficiency ratios

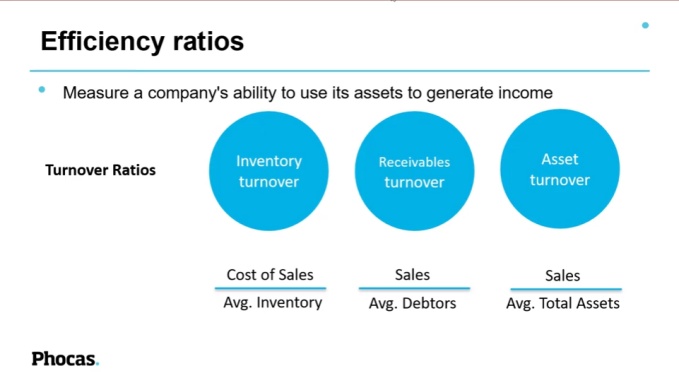

What makes efficiency ratios useful? Efficiency ratios measure a company’s ability to use its assets to generate income. They’re an extremely helpful way to track where your company’s money goes and can help you get paid faster.

The efficiency ratios you use will depend on the area of the business you’re trying to measure. Generally, they fall into the following two groups:

- Turnover ratios. These ratios calculate the number of times that certain areas turnover in a year, such as inventory, receivables, or assets.

Inventory turnover tracks how often stock replenishes in a year. Receivables turnover measures how quickly your company collects its receivables. The higher the number the better, since you want high sales and low debtor values to bring in money from customers more quickly. - Days ratios. Another common type of efficiency ratios, which includes Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Combined, these ratios comprise the Cash Conversion Cycle.

Tracking the cash conversion cycle

A cash conversion cycle is a metric measuring the amount of time it takes to convert stock into cash through the process of purchasing or creating inventory, selling it, and receiving payment.

When it comes to a cash conversion cycle, the aim is to make this as short as possible in a sustainable way. For example, if the DIO is 50 days, the DSO is 60 days, and the DPO is 30 days, the cash conversion cycle would be 50+60-30=80 days.

When you want to improve your cash conversion cycle, you can focus on any of these individual metrics:

- Reduce DIO by improving planning and forecasting to ascertain how much inventory you'll need at different times, and figure out when to optimize inventory levels to meet demand.

- Reduce DSO by sending invoices sooner, offering customers several ways to pay, and setting up a system that sends out automatic payment reminders.

- Increase DPO by paying as close as possible to the due date or negotiating longer terms with suppliers.

How to use efficiency ratios for maximum value

Using efficiency ratios works best when you track them over time. If you notice, for example, that customers are taking longer to pay, you can reach out to them with an invoice reminder or find out when they can send a payment. On the other hand, if your DPO is rising, you can reach out to suppliers to communicate that your organization needs additional time to pay, which can help avoid any supply issues.

Although it can be difficult and time-consuming to track a cash conversion cycle in a spreadsheet, modern solutions like Phocas software enable you to compare the efficiency ratios, such as DIO, DSO, and DPO, in a single view. You can then start to notice trends and quickly develop plans to deal with problems, like if your business is holding onto the stock for too long or customers are taking too long to pay for it.

In Phocas, you can also add the day’s ratios to your income statement. Adding these custom calculations is straightforward, and ensures your team can monitor the trends over time and make more informed, data-driven decisions.

In these challenging times, efficiency ratios can help ensure your company gets paid faster, so you’re never left wondering where the money has gone.

To learn more about how Phocas’s financial solutions can deliver a festival-like experience for your finance team, download this ebook: Modern Financial Planning and Reporting.

Chartered accountant and expert adviser on streamlining budgeting and reporting for the mid-market.

What is management accounting and how does it help with operational decision-making?

People in business are always looking for new ways to leverage their data, streamline their operations and work more efficiently. There are many ways to do this, but one of the most powerful is management accounting—a concept that has been around for decades but has had a resurgence thanks to the increasing sophistication of modern data platforms.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Is real-time financial reporting working for your business?

What tools and technology do you use for real-time financial reporting? If your answer includes Excel spreadsheets, you’re (believe it or not) in the majority.

Read more

What is a flash report and how to create them effectively

A flash report is a snapshot of current financial performance and operational performance metrics. For many decision-makers, these reports are essential. However, for the accounting department, creating these reports daily or weekly can be excruciating. Yet, the delivery of flash reports is often a non-negotiable. These reports must be on everyone's desk at the same time, regardless of what data needs to be pulled or stitched together. This blog aims to provide some alternative ways to automate and deliver these telling reports so everyone can be across business performance.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today