Phocas launches new budgeting software

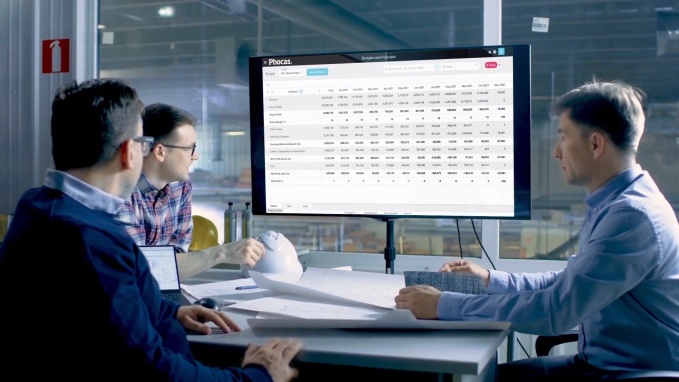

For many, the budget process is a dreaded task or a necessary evil. Yet we also know an accurate budget is the backbone of a well-run organization. So, in line with our goal of adding value to the finance team, it’s with great excitement that our new dynamic budgeting software launched this week. Phocas Budgeting and Forecasting saves the finance team valuable time and makes companywide analysis and budgets easy-to-do tasks. Now your budgets can be both ambitious and realistic while being simple to adjust as your market lifts or dips.

What sets Phocas budgeting software apart?

The new software enables finance teams to build budgets in a live data analytics environment. A dynamic environment means when a budget template is set-up, you have access to all of your historical and current data. For example, when you forecast revenue per product line or division, you can click into each category and have easy access to last week, quarter or year’s figures without opening another system or consulting a different spreadsheet.

With the numbers at your fingertips, this cloud-based software allows teams to budget and forecast in the one place from anywhere. As Phocas product consultant, Dan Harrison explains, “it’s a real-time tool that’s integral to all business units.”

Dan Harrison joined the Phocas finance team, as the in-house expert on the mid-market budget process. As a chartered accountant, he knows first-hand, the intensity of the finance team's budget process and the pressure to check and cross-check all the assumptions and calculations presented in a set timeframe. At the product launch, he explained that Phocas encourages all business managers to adopt modern budgeting software, so their budgets accurately reflect actual companywide performance.

Collaboration with budgeting workflows

People outside of the finance team, such as branch managers or product managers, who contribute to the budget also find the traditional process tedious. Their input is often not reflected in the final budget, so taking part is seen as counter-productive or a waste of time.

The new Phocas Budgeting and Forecasting tool has in-built workflows and drivers to encourage greater buy-in and accountability for the numbers.

The workflows enable better co-ordination of the process. The budget owner can assign tasks to other people, that are logged and tracked. There is an audit trail for the tasks so the budget owner can see when the other person responds and the rationale for specific figures. The rationale is called a driver, these are based on actual numbers, or they can be miscellaneous (for instance they might be based on head count, where a manager can put in a cost for mobile phones for each person in the team) - the user decides in the workflow.

Data security and permissions are also integral to the budget tool which works in tandem with Phocas Financial Statements. The budget owner can control access to sensitive information like salaries and ensure different divisions only receive data relevant to their work.

We had been looking for a faster and simpler way to budget to replace Excel. The first impression with Budgeting and Forecasting during testing and working with the team at Phocas has been enlightening. We believe Phocas will help us implement the great game of business methodology within our business, getting more of our team engaged with budgeting, forecasting and understanding the secret language of business “the financials”.

Billy Hart, Group CFO, HG Group (alpha customer)

Looks like a spreadsheet but without the headaches

Finance teams are only too aware of the problems of spreadsheets in the budgeting process. On average most companies with a revenue of over $5million have 20 versions of a budget. Somewhere in this process – the earlier version is worked on by the product team and when it goes back to finance – they have to update the current version all over again. Formulas can also be copied incorrectly making accuracy a problem.

According to Ventana Research: ‘On average financial managers, waste as much as 18 hours per month manually updating, revising, consolidating, modifying and correcting spreadsheets.”

Spreadsheets remain the ubiquitous budget tool for many finance teams, so the Phocas budgeting software's design goal is to provide a familiar spreadsheet feel.

"We want people to be comfortable using the new budgeting software so it made sense to give it a similar flow of a spreadsheet with drag and copy for ease-of-use. Still, the real benefit to the user — is the removal of all limitations of spreadsheets — like version control and validations," explains Dan.

The Phocas Budgeting and Forecasting software makes budgets an ongoing asset. Budgeting is live and therefore no longer a dreaded annual event. The numbers presented are easier to understand, and the intuitive workflows save the finance team valuable time and encourage more companywide engagement in the process.

Katrina is a professional writer with experience in business and tech. She explains how data can work for business people without all the tech jargon. She is always on the look out for new ways data is being used by business people to know more and be sustainable.

Departmental budgeting: how it works and how it helps you reach departmental goals

If you’re in business, here’s something you probably already know: at the core of any robust, well-managed company is a robust, well-managed budgeting process. Effective financial planning is more than spreadsheets—it establishes a strong framework with accurate data that helps guide all levels of the business and keeps you on track with your strategic goals.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Why reforecasting is crucial in financial planning

Budgets and forecasts need to work together. When finance teams and business leaders can track actuals versus budgets, reforecasting can become timely and accurate. This helps your strategic planning stay on track and allows you to deal with major changes in your business environment.

Read more

FP&A (Financial Planning & Analysis) software versus Excel

What tools are necessary to carry out financial planning and analysis (FP&A) in a mid-size business? The safe answer is Excel spreadsheets. Yet the real requirement for running a business with a $5 to $50 million turnover is a planning tool that allows team members to improve decision making rather than build cumbersome financial models.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today