15 common financial KPIs - which ones are you measuring?

Every business has a range of priorities that compete for importance and attention as it grows. Key Performance Indicators (KPIs) are metrics that are designed to help cut through the noise, so that an organisation’s decision makers and staff can focus on what's really important.

There are many types of KPIs but perhaps some of the most important ones are financial. Financial KPIs are used to measure, track, and analyze progress toward departmental, or company-wide goals. As there are more financial KPIs than a small or mid-sized business could possibly adopt, it’s important to select the ones that best fit your company strategy.

In this blog, we explore what financial KPIs are, why they’re important for the financial health of your business, how to select the right financial KPIs and which ones made our 15 most common shortlist.

What are financial KPIs?

No one has a crystal ball, but financial KPIs come close. Financial KPIs are a collection of distinct metrics that are used to monitor and assess your organization’s short-term obligations and long-term financial performance. Everyone wants insights and that’s why KPIs matter; the right combination of financial metrics allows you to accurately evaluate financial, strategic, and operational successes and challenges.

With your financial KPIs in hand, you can develop solutions and implement changes to correct issues and create new business strategies. Sometimes you can even benchmark your KPI financial metrics against competitors or industry standards, which helps to provide additional insights into your company’s performance.

Creating manageable financial KPI categories

Financial reporting is a complex area, covering revenue, expenses, profits, assets, liabilities and equity, and multiple other financial outcomes and there’s a significant amount of data required to measure each. Financial key performance indicators can be broken down into smaller categories, which makes it easier to manage your data and get targeted insights.

When selecting your organization’s financial KPIs, consider grouping them into categories like this:

Liquidity KPIs

Liquidity ratios measure a company’s ability to repay both short-term and long-term debt obligations. These ratios provide insight into a company's liquidity position by comparing its liquid assets, such as cash and cash equivalents, to its short-term liabilities. Higher liquidity ratios indicate a stronger ability to cover short-term debts and expenses, while lower ratios may suggest potential cash flow challenges.

Example liquidity KPIs include the current ratio, quick ratio and cash ratio.

Profitability KPIs

Profitability ratios are financial metrics that measure and evaluate the ability of a company or department to generate profit relative to revenue, balance sheet assets, operating costs, and equity during a specific period. They show how well a company uses its assets to produce profit and value for shareholders.

Profitability KPIs are particularly useful internally when comparing the relative performance of departments or business units side by side.

Example profitability KPIs include gross margin, operating margin and net profit margin.

Efficiency KPIs

Efficiency ratios, also known as Activity Financial Ratios, are used to measure how well a company is using its assets and resource. Efficiency ratios when measured over time can highlight concerning trends or measure the benefit of investment in operations.

Example efficiency KPIs include receivable turnover ratio, inventory turnover ratio, asset turnover ratio and days payable outstanding.

Which financial KPIs are the best?

It’s easy to get overwhelmed with KPIs because there are so many to choose from and the importance of each is likely to shift over time. The good news is you don’t need to monitor that many KPIs to generate plenty of value.

The most important thing is to determine which financial metrics will help you to achieve your objectives and strategies, whilst not overwhelming the organisation and causing more work than is necessary.

Selecting the right financial KPIs for your organization

Deciding which financial metrics are best for your organization can be a difficult task. While some are universally applicable and employed, such as revenue growth, profit margin and days to pay ratios, others are industry specific.

When selecting your financial KPIs, start by considering what is standard practice in your industry and which KPIs are typically used by your competition. Monitor performance over time across all of these different financial KPIs; reviewing which way they are trending and narrowing down a few KPIs that the whole organisation should be focusing on to bring about the biggest change.

Continuously evaluate performance against these, all the while not losing sight of other KPIs that could become more important. For example, if you focus on recruiting sales staff, they may initially increase your year-on-year revenue growth to a point, but as you grow, you may lose sales efficiency and sales costs may spike, so your focus may then needs to shift to a cost of acquisition type ratio to try to maximise your sales per dollar spent.

Here are a few additional factors to consider when selecting the best financial KPIs for your business:

- Company goals

- Business model

- Specific operating processes

- Company size

When evaluating these factors and selecting KPIs, it’s critical to collaborate with the various business units and stakeholders at your organization. Your finance team will want to offer input into what key performance measures to track from finance data.

Let’s explore the most common 15 KPIs for financial reporting and why they’re so important for your business.

Financial metrics: 15 common financial KPIs

If you’re ready to ramp up the monitoring of your financial KPIs, here are some of the top ones to consider:

Sales Growth | Gross Profit Margin | Accounts Payable Turnover | Accounts Receivable Turnover | Working Capital

Current Ratio | Quick Ratio | Operating Cash Flow | Human Capital Value Added | Days Payable Outstanding

Payroll Headcount Ratio | Inventory Turnover | Total Asset Turnover | Return on Assets | Budget Variance

Financial KPI Insights

Now that you know the 15 of the most important financial reporting KPIs, here are some insights to help you choose which ones will drive success for your business.

1. Sales Growth

Sales growth, sometimes referred to as revenue growth, is one of the most crucial revenue KPIs for any company. Your sales growth reveals the change in net sales from one period to the next, expressed as a percentage.

Sales growth rate = (Current net sales – Prior period net sales) / Prior period net sales x 100

Why monitor this financial KPI?

You need to know how much your sales are growing or contracting.

Sales growth is a profitability KPI. Your sales growth KPI compares your current and previous performance, and you can decide whether you compare last year or last quarter.

When is it best to use Sales Growth as a KPI?

Sales growth is one of the most powerful metrics for any organization because it’s directly tied to revenue and profitability. This is a core tool used to measure the overall health of your organization. Check in on your sales growth anytime you want to get a better reading of how your sales are going. And, you shouldn’t only focus on declining sales. If you see an increase, it’s worth digging deeper to understand what is driving this growth. Is it due to price increases, inflation, branch openings or the addition of new product lines? Or is it due to customer acquisition i.e. attracting new customers, or by increasing share of wallet with your existing customers. Observing such trends over a period of time can help to shape future sales & marketing strategies.

2. Gross Profit Margin

The gross profit margin KPI is a vital metric for the profitability and efficiency of an organization's core business competencies. Why? Because this financial KPI deals with the costs directly related to the sale of your product. For example, the cost of the goods that you've sold, costs of labour to produce, package and transport the product. Constant review and management of your cost of goods is pivotal to improving your businesses’ overall net profit, especially if you’re a manufacturer or distributor.

Gross profit margin = (Net sales – Cost of goods sold (COGS)) / Net sales x 100%

Why monitor this financial KPI?

Financial analysts find it simpler to work with profit represented as a percentage of revenue because it’s easier to evaluate profitability trends over a period. It also makes it easier to compare your figures with your competitors. Gross profit margin is a profitability KPI.

When is it best to use Gross Profit Margin as a KPI?

The best time to include gross profit margin as a KPI is when you need to determine where you should reduce or highlight specific products and services that might not be as profitable as originally anticipated.

3. Accounts Payable Turnover

The accounts payable (AP) turnover key performance indicator is a financial ratio that measures how effectively a company is managing its accounts payable. It indicates how quickly a business pays off its suppliers.

A higher AP turnover ratio generally indicates that a company is paying its suppliers more quickly. However, an excessively high ratio might indicate that a business is not taking full advantage of trade credit terms. Conversely, a low turnover ratio may suggest that a company is taking longer to pay its bills, which could signal operational or liquidity issues and cause strain on supplier relationships.

Accounts payable turnover = Net Credit Purchases / Average accounts payable balance for period

Why monitor this financial KPI?

The accounts payable turnover KPI is crucial because it reveals how an organization manages its cash flow. If you have a lower ratio, that means you are holding onto your cash for longer. Accounts payable turnover is a liquidity KPI.

When is it best to use Accounts Payable Turnover as a KPI?

AP turnover is best used as a KPI to assess cash flow management, supplier relationships, and operational efficiency. It also aids in benchmarking against industry peers and identifying trends in payment practices over time.

4. Accounts Receivable Turnover

The accounts receivable (AR) turnover metric shows how quickly and effectively companies collect money owed from customers.

Accounts receivable turnover = Sales on account / Average accounts receivable balance for period

Why monitor this financial KPI?

The accounts receivable turnover KPI tells you the number of times the average AR balance becomes cash in your account during a certain period (often a year).

With this KPI, you can monitor the rate at which you collect money that’s owed to your business. A high AR turnover means that your cash collections are healthy. However, don’t get excited if your AR turnover is too high. A high AR turnover can sometimes indicate that a business is overly aggressive in collection strategies and practices. If customers discover this practice, it might put them off your brand, no matter how diligently and timely they plan to pay. AR turnover is a liquidity KPI.

When is it best to use Accounts Receivable Turnover as a KPI?

If you’re making consistent sales but wonder why your cash collection remains low, you might need to conduct an AR turnover measurement to determine whether too many customers are paying you with credit that goes unpaid.

5. Working Capital

The working capital metrics gauge your business’s financial health by looking at the readily available assets that you could use to cover any short-term financial liabilities, like loan debts.

Assets included in this KPI are:

- Cash on-hand

- Short-term investments

- AR to demonstrate liquidity or the ability to generate cash quickly

Working capital = Current assets – Current liabilities

Why monitor this financial KPI?

The working capital KPI helps measure the ability of your business to fund its current operations and cover its short-term liabilities, from readily available cash and other investments.

There’s a downside to having too much working capital because it could mean that you might not be making the most out of your assets. For example, the cheapest way to fund an organisation’s operations is from cash in the bank if it is available (higher working capital). However, debt allows you to leverage and invest in strategies that you wouldn't otherwise be able to afford (common to lower working capital balances).

A higher level of working capital may be more prudent in times of higher interest rates and lower growth so that you have more coverage for risk, while a lower ratio may be preferred when borrowing costs are lower and a business is looking at the longer-term benefits of leveraged growth.

When is it best to use Working Capital as a KPI?

As your business grows, it tends to become more complex. Although it is advisable to keep your eyes on working capital all the time, it is especially useful when you are reviewing growth strategies and potential methods of funding them. Also, when the interest rate environment is changing (ask yourselves - can we cover our debt?) or when you have significant cash inflows (ask yourselves - are we using our net current assets effectively?)

6. Current Ratio

The current ratio shows your company’s short-term liquidity. Current assets are anything that your business can convert into cash within a defined period. These assets include AR, cash, and inventory. Current liabilities include any debt owed within the current period, such as your AP.

Current ratio = Current assets / Current liabilities

Why monitor this financial KPI?

The current ratio KPI fires up red flags if your company is at risk of not having enough available assets to manage any short-term financial obligations that come up. Current ratio is a liquidity KPI.

When is it best to use Current Ratio as a KPI?

Including current ratio as a KPI is most helpful if you need to prove your company’s liquidity to creditors or investors to take on a new project, buy new equipment, or hire more employees.

7. Quick Ratio

A quick ratio KPI reveals the state of your company’s short-term liquidity, only looking at your most liquid assets. This means that you do not include your inventory as part of your liquid assets in the formula.

Quick ratio = Quick assets / Current liabilities

Why monitor this financial KPI?

The quick ratio KPI measures your organization’s ability to meet short-term financial obligations with your business’s available assets that can be instantly turned into cash.

Quick ratio KPI is a more conservative evaluation of your fiscal health than current ratio because it doesn’t include your inventory as part of your assets. Quick ratio is a liquidity KPI.

When is it best to use Quick Ratio as a KPI?

Anytime you want to reassure your investors, lenders or suppliers - whether by their request or your initiation - that you have plenty of cash on hand to pay current, short-term liabilities, monitoring your quick ratio gives you the ideal financial KPI to have on hand. A good result reveals competence and sound performance.

8. Operating Cash Flow

The goal of operating cash flow (OCF) is to measure a company’s ability to pay for short-term liabilities with readily available cash on hand from core operations. Although somewhat related, it differs to a solvency ratio which is a metric used to measure a company's ability to meet its long-term debt obligations.

Operating cash flow = Operating cash flow / Current liabilities

Why monitor this financial KPI?

You need to understand your operating cash flow in order to know how easily you can pay for deliveries, equipment maintenance, and other operating expenses.

To better calculate operating cash flow and monitor this KPI, refer to your company’s cash flow statements instead of using an income statement or balance sheet. This strategy removes the impact of non-cash operating expenses to provide a clear view of available cash. Operating cash flow is a liquidity KPI ratio.

When is it best to use Operating Cash Flow as a KPI?

When you need to take the pulse of your company’s financial success, an operating cash flow ratio is the way to go. It lets you know whether your company can generate the necessary positive cash flow to pay expenses and take the next steps to grow your operations.

9. Human Capital Value Added

An organization’s employees are vital to daily operations and bottom line and are much more than “intangible assets” since their value is measurable. Employee value added, also known as human capital value added (HCVA), is a measure of the financial value a full-time employee (FTE) brings to the company. In other words, it shows how the average employee contributes to the organization’s bottom line.

HCVA = (Revenue - (Total Costs - Employment Cost))/ Full-time Employees

HCVA is a profitability KPI, indicating the value provided by the employees you hire.

Why monitor this financial KPI?

Since HR departments don’t typically measure the impact employees have on an organization’s financial performance, it’s a good idea to use the HCVA ratio to measure the value that employees add every quarter. Since you pay employees through salary and compensation, it’s vital to know how their work affects the success of your business.

When is it best to use Human Capital Value Added as a KPI?

HCVA is best utilized as a financial KPI when aligning human capital strategies with overall business objectives, assessing workforce efficiency and effectiveness, making informed decisions on resource allocation, and evaluating talent management initiatives.

It is particularly valuable during periods of change, comparative analysis across business units or industries, and in scenarios such as mergers and acquisitions, offering a comprehensive measure of the workforce's contribution to an organization's economic value.

10. Days Payable Outstanding

A days payable outstanding (DPO) KPI is a financial ratio, indicating the average amount of time, expressed in days, that an organization typically takes to pay its invoices, bills and other debts to its trade creditors, such as financiers, vendors and other suppliers of goods and services.

Businesses that use this KPI typically do so quarterly or annually to gauge how well their cash outflows are being managed.

DPO = Ending Accounts Payable / (Cost of Sales / Number of Days)

Why monitor this financial KPI?

Days payable outstanding is a liquidity KPI that helps determine how much cash is on hand (near-term liquidity) while taking an extra stretch of time to pay a supplier without any penalties. That means your organization can use this cash without restrictions to benefit your profit margins and increase free cash flows (FCFs).

When is it best to use Days Payable Outstanding as a KPI?

If you need some extra bargaining power for an upcoming purchase for your organization, a positive DPO can help you negotiate more favorable terms, such as payment date extensions and price reductions. Having DPO as a KPI shows that you’re monitoring it over time.

11. Payroll Headcount Ratio

The Payroll Headcount Ratio is a financial KPI used by businesses to evaluate their efficiency in managing labor costs relative to their overall workforce size. It is calculated by dividing the total payroll expenses by the average number of employees during a specific period.

Payroll Headcount Ratio = Total Payroll Expenses / Average Number of Employees

Why monitor this financial KPI?

The purpose of this ratio is to provide insights into how much a company is spending on compensating its employees relative to the size of its workforce. A higher ratio indicates that your company is spending more per employee on average, while a lower ratio suggests more efficient cost management.

When is it best to use Payroll Headcount Ratio as a KPI?

The Payroll Headcount Ratio can assist your business with evaluating payroll expenses relative to workforce size, aiding in cost management and operational efficiency analysis. It also serves as a benchmarking tool for comparing against industry standards, guiding financial planning and strategic decision-making.

12. Inventory Turnover

Want to know how often inventory is bought, sold, or replaced within a specific timeframe? Then you need to monitor your inventory turnover KPI.

Inventory Turnover is the number of times a business sells and replaces its stock of goods during a given period. It considers the cost of goods sold, relative to its average inventory for a year or in any set period.

Inventory turnover = Cost of goods sold (COGS) / Average inventory balance for period

Why monitor this financial KPI?

Knowing your inventory turnover can help you make better decisions regarding manufacturing, pricing, marketing, reordering, and purchasing new inventory. It reveals how well your processes are working and resulting in sales that lead to making more informed future decisions. Inventory turnover is a valuation KPI.

A high inventory turnover generally means that goods are sold faster, and a low turnover rate indicates a higher risk of excess inventories and obsolete stock. It also highlights more working capital is tied up in inventory. You should like to break inventory into is different groups to identify different challenges with different product groups or suppliers. Perhaps there are sales being lost due to a lack of stock or particular product lines that are moving slower or at higher risk of obsolescence or expiry.

When is it best to use Inventory Turnover as a KPI?

If you want to stay in touch with how well your stock is turning over to determine your cash flow, this KPI is crucial to monitor. If your stock sits dormant in your warehouse for too long, it also ties up your cash flow. Ultimately, including inventory turnover as a KPI lets you know how your inventory is performing and whether you might need to make some changes.

13. Total Asset Turnover

The total asset turnover measures how efficiently assets are used. It takes into account the value of your organization’s sales or revenue numbers relative to the value of its overall assets.

Total Asset Turnover = Revenue / (Beginning Total Assets + Ending Total Assets / 2)

Why monitor this financial KPI?

The total asset turnover KPI can show how efficiently your business uses assets to generate revenue. Total asset turnover is an efficiency KPI.

When is it best to use Total Asset Turnover as a KPI?

If you need to make new purchases, total asset turnover is a vital KPI to help in your decision-making. The calculation lets you see all your assets, such as equipment, real estate, cash, furniture, vehicles, and receivables. With this information, you can determine if you want to use them to fund your company’s operations and generate even more revenue.

14. Return on Assets

The return on assets (ROA) KPI shows how well your company’s operational management team uses assets to generate profit. The assets considered include AR, inventory, and fixed assets like real estate and equipment owned.

ROA = Net Profit / (Beginning Total Assets + Ending Total Assets) / 2

Why monitor this financial KPI?

ROA KPI reports provide investors and stakeholders with insights into how efficiently your company’s management is using assets to generate earnings. ROA is an efficiency KPI.

When is it best to use Return on Assets as a KPI?

When you want to get a better idea of how your managing team is doing at earning money from your assets, ROA is a great KPI. This ratio tends to vary by company and is highly dependent on industry. For example, a software company will have a very different ROA to a wholesale distribution business.

It therefore lends itself to comparison, either to another similar company, or to an industry benchmark.

15. Budget Variance

Budget variance compares your business’s actual performance against projected budgets and forecasts. You can apply this KPI to any variance you choose to analyze, such as expenses, revenue, or profitability. For example, you could compare your total revenue versus budget to track growth.

Budget variance = (Actual result – Budgeted amount) / Budgeted amount x 100

Why monitor this financial KPI?

Budget variance lets you compare anticipated budgets and expectations against your business’s actual performance.

If something is amiss, and you discover an unfavorable budget variance, this valuation KPI lets you get to the bottom of things faster to make corrections. This KPI helps with solid planning and enables you to change course if anything doesn’t match your expectations. Budget variance is a valuation KPI.

When is it best to use Budget Variance as a KPI?

Frequently used in project management, budget variance is useful for detecting and understanding any budgetary anomalies, such as being lower to anticipated budgets.

For ongoing budget measurement in Phocas, finance teams can integrate a budget model with Phocas Financial Statements, allowing for easy comparison with actuals in order to monitor variances. The budget figures and actuals can be visualized through graphs and charts, segmented into branches and divisions, so you can constantly connect all your people to financial performance.

Simplify your KPI metrics monitoring with powerful and easy-to-use data visualization software

Financial key performance indicators are critical to track, but many organizations struggle to do this consistently and effectively across their business. For example, they may find it difficult to drill down into or roll up their data, compare business unit performance like-for-like or easily make changes and amendments to the ratios and have them reflected in all their reports company-wide.

Think about your own business and how challenging it can be to extract data from your ERP system, merge this data with other data sources and then analyze it using spreadsheets alone. Establishing financial KPIs and monitoring them adds another layer of complexity that can simply feel unattainable for some businesses using traditional methods.

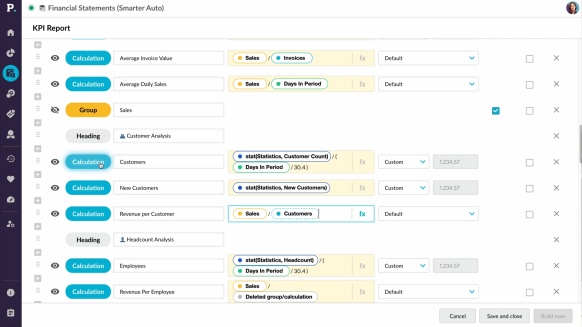

With dedicated analytics software, your financial team has access to real-time numbers, can automate various calculations, create + share data visualizations and set up easy-to-use KPI dashboards that present all your metrics and numbers in one central place.

Using Phocas, KPI monitoring and measuring becomes a living, breathing process that helps business leaders, managers, and staff quickly see how important financial KPIs are performing now and over a period of time, as well as keeping each other and stakeholders fully informed.

Contact us to learn more about the 15 KPIs listed above or any others you feel are relevant to your business.

Before joining Phocas as an in-house tech writer, Ali worked as a freelancer and brings a wealth of industry experience to her writing. She previously occupied a senior management position at a national distributor of plumbing and building supplies in the UK. Ali has a genuine passion for writing about ways to help businesses feel good about data.

Departmental budgeting: how it works and how it helps you reach departmental goals

If you’re in business, here’s something you probably already know: at the core of any robust, well-managed company is a robust, well-managed budgeting process. Effective financial planning is more than spreadsheets—it establishes a strong framework with accurate data that helps guide all levels of the business and keeps you on track with your strategic goals.

Read more

How to prepare professional board reports

Preparing effective board reports cannot be underestimated in the ever-changing and dynamic business world. They’re not only essential for communicating financial performance and operational progress, but they’re also an all-important part of strategic and intelligent decision-making.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Why reforecasting is crucial in financial planning

Budgets and forecasts need to work together. When finance teams and business leaders can track actuals versus budgets, reforecasting can become timely and accurate. This helps your strategic planning stay on track and allows you to deal with major changes in your business environment.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today