What festival vibes can be given to profitability ratios

There’s nothing quite like the experience of attending a festival.

Whether the focus is food and wine, art, or music, a festival can deliver top-notch cultural offerings and experiences. The variety of options available, and the excitement of exploring these options, often make these festivals unforgettable and can’t-miss events.

Why not bring those festival vibes to your finance department? In finance, you have an array of options to explore that can help you understand your company’s performance, make data-driven decisions, and deliver better results. A festival of metrics, particularly profitability ratios, can allow you to explore the best of what these increasingly important financial metrics have to offer.

Why profitability ratios matter

You know what profitability ratios are, but why are they important? Profitability ratios can provide a quick reference point for how well your company is doing. One that you can easily compare to past periods in company history, or between departments to foster friendly competition. Often cross departmental trends can provide great insight into how different areas are managed within your own business.

Just like a festival offers limitless options to explore for all tastes and interests, profitability ratios can be customized based on the data you’re looking for. Want to know if your costs are increasing over time? Try the Operating Expenses Ratio. Or is your organization focused on growth and needs to raise capital? Then the Return on Equity is your ratio.

Profitability ratios fall into two buckets:

- Margin ratios, such as gross margin, operating profit margin, net profit, can show how well your organization turns sales into profit at different levels of your statement.

-

Return ratios, such as return on equity, return on assets, return on capital employed, provide insights into your company’s ability to generate returns.

Why ratios can uncover areas of your business that need work

When you track profitability ratios, you can quickly and easily pinpoint areas of concern that need work. For example, if your Net Profit Margin is declining over time, that could mean you’re seeing fewer orders or losing customers.

If your Operating Expenses Ratio increases over time, that may mean your organizational operating costs are growing relative to sales or revenue. This may, in turn, mean that your company will need to think about implementing cost control practices.

Why ratios trump numbers

Numbers can be useful, but they don’t tell the full story about your company’s performance, such as how well your company turns revenue into profits and how much your company is bringing in after all direct manufacturing-related costs.

Ratios effectively look at two numbers relative to one another and provide an objective, standardized method of measuring company performance. Ratios compare different entities in your business and can be used to see hoe how you stack up against other companies in your industry. They provide a more complete financial picture since they allow you to explore relationships between different areas of the business.

How to use profitability ratios well

Like any well-executed festival, a festival of ratios requires proper planning. When your data is up-to-date and all in one place, profitability ratios can provide critical insights for day-to-day decision-making. That enables your people to understand the company’s performance at a moment’s notice and make necessary changes.

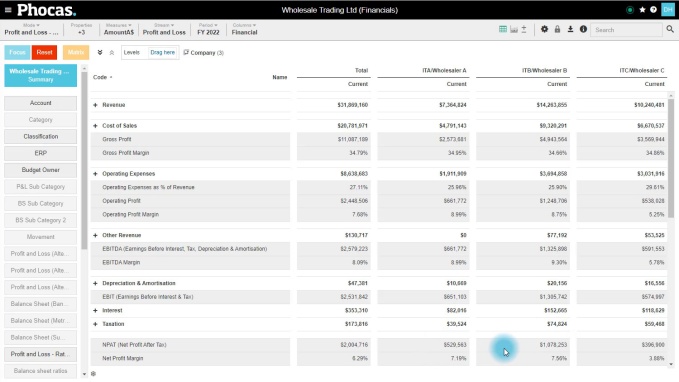

Having a financial analysis solution like Phocas turns calculating ratios into a painless, automatic process. The solution pulls data from all of the company’s ERPs and consolidates them in one place. You can filter data by period, region, company divisions, or channels and drill down into each data point for more detailed insights over time.

When you use profitability ratios over time, you can begin to track trends and patterns, and quickly diagnose problems if the ratios suddenly dip.

How do your profitability margins stack up

Visiting a festival is often an opportunity to see how your culture compares to others. Similarly, you can see how your company’s ratios compare to industry standards. This can help show you how well your company is performing and identify its strengths and weaknesses.

You can find ratio values for organizations in your local area by consulting your local Board of Trade, Chamber of Commerce, or industry association. Industry standards reports, typically accessible online, can also be valuable sources of information.

Examples include Risk Management Association’s Annual Statement Studies, Dun & Bradstreet’s Key Business Ratios on the Web, and Wolters Kluwers’ Almanac of Business and Industrial Financial Ratios.

Your team's data insights from profitability ratios can uncover hidden insights and drive more detailed decision-making. To learn more about how Phocas’s financial solutions can deliver a festival-like experience for your finance team, download this ebook: Modern Financial Planning and Reporting.

Chartered accountant and expert adviser on streamlining budgeting and reporting for the mid-market.

What is management accounting and how does it help with operational decision-making?

People in business are always looking for new ways to leverage their data, streamline their operations and work more efficiently. There are many ways to do this, but one of the most powerful is management accounting—a concept that has been around for decades but has had a resurgence thanks to the increasing sophistication of modern data platforms.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Is real-time financial reporting working for your business?

What tools and technology do you use for real-time financial reporting? If your answer includes Excel spreadsheets, you’re (believe it or not) in the majority.

Read more

What is a flash report and how to create them effectively

A flash report is a snapshot of current financial performance and operational performance metrics. For many decision-makers, these reports are essential. However, for the accounting department, creating these reports daily or weekly can be excruciating. Yet, the delivery of flash reports is often a non-negotiable. These reports must be on everyone's desk at the same time, regardless of what data needs to be pulled or stitched together. This blog aims to provide some alternative ways to automate and deliver these telling reports so everyone can be across business performance.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today