Why financial transparency improves employee confidence

As a finance team member, you know how important it is to regularly share financial data and insights with key stakeholders. But you might want to consider sharing those numbers with Sue in Sales or Joe in Marketing, too.

When you share financial information with all employees, it can help them understand the big picture, such as how the company is performing. That might mean sharing both the positive and the negative aspects, even when cash flow is tight in some areas. Armed with this important information, your employees can perform their jobs more confidently and capably.

Financial transparency means that you provide regular updates on financial information to employees, inviting them to take part in planning and budgeting. You can even offer the entire organization access to financial data and insights — without adding any more work to your plate or affecting the general ledger.

When considering investment decisions and initiatives, it's crucial to ensure that your employees have a clear understanding of the company's financial position. By providing transparent financial data, you empower them to make informed decisions that align with the company's goals.

When done correctly, financial transparency can provide a much-needed boost to employee confidence. Fundamentals, such as a strong balance sheet and a clear bottom line, play a vital role in building trust among employees. Clearly articulating these fundamentals during financial reporting helps employees see the stability and health of the organization.

Common obstacles to financial transparency

Before you share financials with non-finance employees, you might worry about whether they’ll not understand the numbers or if that will throw them off track from their usual day-to-day tasks. Some Finance teams might be so bogged down with manual tasks that they can’t spare extra time to educate co-workers on basic financial terms.

Handing over a stack of papers with a bunch of numbers might not necessarily result in financial literacy. You need an intuitive, easy-to-use system that makes it simple for all employees to view financial information and even offer their own contributions and calculations.

Easing the transition to financial transparency

The first step to getting everyone on board with financial transparency is to share reports with employees. Explain how the reports work, why you’re sharing them, and how employees can contribute. Show them examples of reports and explain what the key terms and metrics mean.

Let them ask questions, not only about financial terminology and procedures but about the reasoning behind certain expenditures. It might be uncomfortable at first, but it is key to creating a culture that recogizes the importance of financial transparency.

Employees want to know that their contributions or ideas matter. Make sure they know that you welcome their insights and questions about financial reports and data.

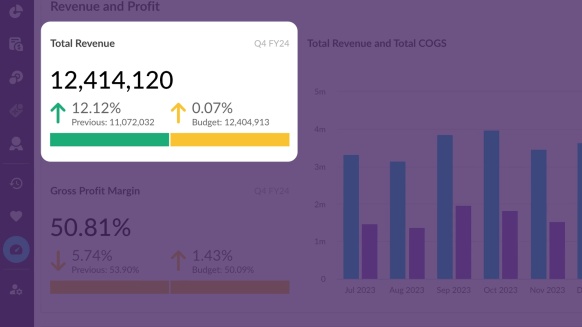

Many companies find it helpful to take advantage of a digital tool that facilitates sharing of key financial information with other members of the team. Phocas's financial statements solution, for example, allows you to retain control over the level of access employees have, but they will be able to review numbers, add custom calculations, create dimensions and sub-categories, and convert numbers and tables into visual charts and graphs on custom dashboards.

Best of all, everyone is looking at the same set of numbers – there’s no need to worry about several versions of spreadsheets floating around the workplace.

With the help of the Financial Statements tool, you can quickly and easily generate reports for anyone in the company. Your co-workers in the warehouse and Sales can quickly identify expense issues and even spot new revenue opportunities.

The benefits of financial transparency

When your co-workers understand the complete financial picture and company performance, it can be a total game-changer. Here are some of the key benefits of financial transparency:

- Employees gain an understanding of how the company is performing and how their day-to-day work makes an impact — boosting confidence and enabling high-quality decision making.

- With everyone accessing the same up-to-date data, opportunities for collaboration and additional insights grow.

- Other managers are empowered to make fast, accurate decisions with insight into financial data.

- You’re improving employees’ financial literacy, equipping them with valuable skills they can use in their personal and professional lives.

- Teams can more easily understand financial changes, adapt, and remain committed to company goals, making it easier to take ownership of their own work.

Managing financial planning and analysis (FP&A) can and should be a company-wide exercise. An openness with numbers facilitates better decision-making, improves employee confidence, and can drastically change how the rest of the company views finance.

Phocas' BI and FP&A platform empowers people to perform in-depth data analysis, create custom dynamic financial reports, build budgets and forecasts and manage rebates. Making it easier for you to share data, gather insights, and collaborate with anyone in the organization.

Lindsay is an experienced writer with a passion for translating complex content into plain language. Specializing in the software industry, she explains the importance of data access and analysis for all businesspeople, not just the data experts.

Departmental budgeting: how it works and how it helps you reach departmental goals

If you’re in business, here’s something you probably already know: at the core of any robust, well-managed company is a robust, well-managed budgeting process. Effective financial planning is more than spreadsheets—it establishes a strong framework with accurate data that helps guide all levels of the business and keeps you on track with your strategic goals.

Read more

4 reasons why BI and FP&A tools improve financial reporting

How much time does your finance team spend collecting, analyzing, and sifting through data? According to a Deloitte report, finance teams spend nearly half their time on creating and updating reports. Operating at such a tactical level leaves little room for strategic analysis or effective planning.

Read more

Why reforecasting is crucial in financial planning

Budgets and forecasts need to work together. When finance teams and business leaders can track actuals versus budgets, reforecasting can become timely and accurate. This helps your strategic planning stay on track and allows you to deal with major changes in your business environment.

Read more

FP&A (Financial Planning & Analysis) software versus Excel

What tools are necessary to carry out financial planning and analysis (FP&A) in a mid-size business? The safe answer is Excel spreadsheets. Yet the real requirement for running a business with a $5 to $50 million turnover is a planning tool that allows team members to improve decision making rather than build cumbersome financial models.

Read more

Find out how our platform gives you the visibility you need to get more done.

Get your demo today